What is Crowdfunding?

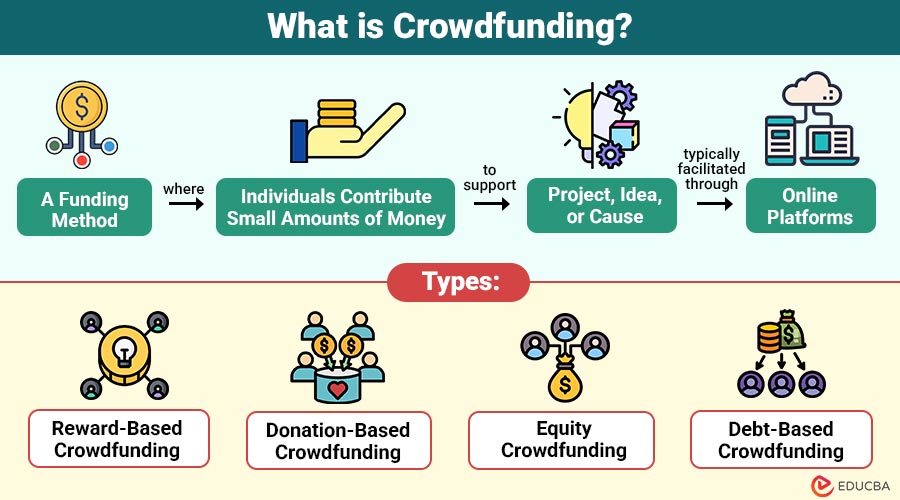

Crowdfunding is a funding method where individuals contribute small amounts of money to support a project, idea, or cause, typically facilitated through online platforms.

Unlike traditional financing, which relies on a single source of funding, such as banks or investors, crowdfunding harnesses the collective power of a community. By pooling contributions from thousands of people, entrepreneurs, creators, or social activists can secure capital while simultaneously validating their ideas in the marketplace.

For example, A startup launching a smartwatch may use Kickstarter to raise $500,000 from 10,000 backers, each pledging $50.

Table of Contents:

Key Takeaways:

- Crowdfunding enables creators to gather small contributions from a large audience, effectively validating their ideas and projects.

- Reward, donation, equity, and debt models offer diverse funding options for projects and causes globally.

- Successful campaigns build communities, generate marketing exposure, and mitigate financial risks before product launch.

- Challenges such as competition, execution delays, trust issues, and platform fees necessitate careful planning and management.

How does Crowdfunding Work?

The crowdfunding process usually involves the following steps:

1. Idea/Project Creation

An entrepreneur, creator, or individual identifies a unique concept or need, outlining objectives, potential benefits, and the target audience.

2. Campaign Launch

The project is launched on a crowdfunding platform with detailed descriptions, funding goals, timelines, visual content, rewards, and requirements.

3. Promotion & Marketing

Campaign creators actively promote their project using social media, email campaigns, influencer partnerships, and press coverage to attract potential backers.

4. Contributions

Backers pledge or donate varying amounts, sometimes receiving rewards, equity, or recognition in exchange for their valuable support and contributions.

5. Goal Achievement

When funding targets are met, crowdfunding platforms release funds to project creators, often only if full goals are successfully achieved.

6. Execution & Delivery

Project teams utilize raised funds for execution, product development, service delivery, and fulfilling promised rewards or benefits to backers.

Types of Crowdfunding

Crowdfunding is not one-size-fits-all. Depending on the goal, different models are available:

1. Reward-Based Crowdfunding

To encourage involvement and loyalty, backers exchange their financial contributions for non-cash benefits, such as early access, products, or exclusive events.

2. Donation-Based Crowdfunding

Individuals contribute money purely out of goodwill, with no financial returns, commonly supporting charities, medical needs, and community initiatives worldwide.

3. Equity Crowdfunding

Contributors invest money and receive ownership shares or equity, enabling startups to raise capital while sharing company success with backers.

4. Debt-Based Crowdfunding

Also known as crowdlending, individuals provide loans to businesses or individuals, receiving repayment with interest, thereby functioning as decentralized online lending institutions.

Benefits of Crowdfunding

Crowdfunding has gained immense popularity due to its unique advantages:

1. Access to Capital

Entrepreneurs and individuals can bypass traditional banks and investors by raising funds directly from a large audience willing to support their projects.

2. Market Validation

A successful crowdfunding campaign demonstrates real demand for a product or service, providing insight into customer interest before full-scale production.

3. Community Building

Backers often become loyal advocates and customers, forming a supportive community that helps promote, improve, and sustain the project in the long term.

4. Lower Financial Risk

Crowdfunding enables creators to secure funds before manufacturing or providing a service, thereby reducing financial risk and avoiding significant upfront investment losses.

5. Marketing & Exposure

Crowdfunding campaigns gain visibility through platform exposure, social media sharing, and PR, generating awareness and attracting new supporters and customers.

6. Flexibility

Crowdfunding suits diverse goals, including startups, social causes, creative projects, and personal needs, offering adaptable funding solutions for various purposes.

Challenges of Crowdfunding

While attractive, crowdfunding has its challenges:

1. Campaign Failure

Not all crowdfunding campaigns achieve their funding goals, resulting in wasted time, resources, and effort for creators, despite well-planned strategies.

2. High Competition

Thousands of projects compete simultaneously on crowdfunding platforms, making it difficult for new campaigns to gain visibility and attract potential backers.

3. Trust Issues

Some backers hesitate to contribute due to fears of scams, project mismanagement, or creators failing to deliver promised results or rewards.

4. Execution Risks

Even successfully funded projects may encounter challenges during execution, resulting in delays, quality issues, or a failure to fulfill backer commitments effectively.

5. Platform Fees

Crowdfunding platforms often charge a 5–10% commission on funds raised, plus additional payment processing fees, which reduces the total amount available to creators.

6. Regulatory Hurdles

Equity and debt-based crowdfunding models are subject to strict legal regulations, requiring compliance with securities laws and financial reporting requirements.

Real-World Examples

Here are some notable crowdfunding campaigns that achieved remarkable success:

1. Exploding Kittens (Card Game)

- Raised $8.7 million on Kickstarter.

- Showcased how entertainment projects can go viral.

2. Oculus Rift (Virtual Reality Headset)

- Raised $2.4 million on Kickstarter.

- Crowdfunding boosted Oculus, which Meta later acquired

3. Coolest Cooler (Portable Cooler)

- Raised $13.3 million on Kickstarter.

- Massive interest made it top-funded.

Crowdfunding Use Cases

Crowdfunding spans multiple domains:

1. Startups

Entrepreneurs use crowdfunding to launch innovative products, raise equity, test market demand, and attract early adopters for business growth.

2. Creative Industries

Artists and creators fund films, books, music albums, and other creative projects while engaging audiences and building loyal communities.

3. Charities

Individuals and organizations efficiently raise money to support humanitarian initiatives, disaster relief, social causes, and charitable programs worldwide.

4. Healthcare

Crowdfunding helps fund surgeries, medical treatments, research projects, and innovative healthcare solutions for patients lacking sufficient financial resources.

5. Community Development

Local communities fund projects such as schools, parks, infrastructure, and community initiatives, thereby improving the quality of life and fostering civic engagement.

6. Technology

Developers fund gadgets, apps, hardware, and tech innovations, validating demand, generating early users, and attracting investors for future growth.

Frequently Asked Questions (FAQs)

Q1. Is crowdfunding legal?

Answer: Yes, crowdfunding is generally legal in most countries, although equity and debt models are subject to regulation by financial authorities.

Q2. What percentage do crowdfunding platforms take?

Answer: Most platforms charge 5–10% commission, plus transaction fees.

Q3. Can individuals crowdfund for personal reasons?

Answer: Yes, many platforms, such as GoFundMe, allow campaigns for medical bills, education, or emergencies.

Final Thoughts

Crowdfunding is a transformative financing method that empowers entrepreneurs, creators, and individuals to bring their ideas to life through collective global support. It democratizes access to capital, fosters innovation, and builds communities. Despite risks such as competition and execution challenges, strong ideas, effective storytelling, and targeted outreach ensure success. With evolving technologies like blockchain, AI, and DeFi, crowdfunding becomes more transparent, accessible, and impactful for startups, social causes, and personal needs.

Recommended Articles

We hope that this EDUCBA information on “Crowdfunding” was beneficial to you. You can view EDUCBA’s recommended articles for more information.